WithHolding Tax Summary.

Based on compliance with the relevant Tax Laws, Betking is now mandated to deduct 5% Withholding Tax from agent commissions/bonuses. This change was implemented from Monday, October 23rd, 2023.

Kindly provide your Tax Identification Number (TIN) HERE and if you don’t have it, visit the State Internal Revenue Service/ Tax Office nearest to you to obtain your Tax Identification Number (TIN) and fill in the form.

Betking as a corporate responsible company is obliged to abide by the WHT Law. However, we will continue to remit the VAT 7.5% on commission/bonus and other levies (including Agent Tax, Signage Fee, Business Premises, Integrated Tax, etc.) on your behalf.

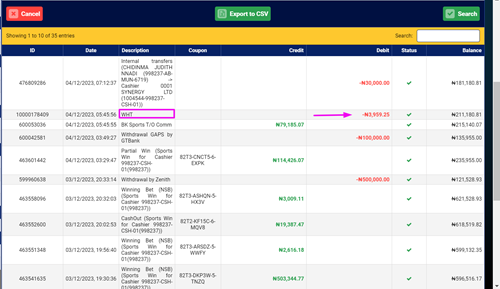

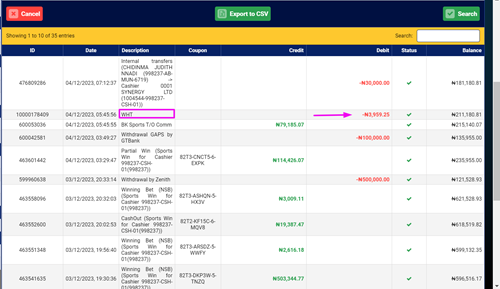

The Transactions would be identified on the agent reports as WHT. See the screenshot below.

FAQ’s

FAQ’s

● What is WHT?

Withholding Tax (“WHT”) is a form of advance payment on income tax. It may be used as a tax credit in offsetting income tax liability. The rate of Withholding tax for individuals is 5%. The Personal Income Tax Act requires a Company paying for a service (e.g. Agency Service) to deduct Withholding Tax on such payment for service and remit it to the relevant tax authorities.

● Why was there a deduction of WHT on my account?

Based on compliance with the relevant Tax law, Betking shall no longer cover the WHT being remitted on behalf of agents. The 5% WHT shall now be deducted from agent commissions/bonuses. This change was implemented from Monday, October 23rd, 2023.

● Why was WHT deducted more than once?

5% WHT is deducted from every commission and bonus earned. Multiple WHT deductions on a Particular Commission plan are not the right behavior and should be flagged.

● What percentage is deducted as withholding tax?

5% of Agents’ commissions & Bonus

● How frequently are withholding taxes deducted from commissions and bonuses?

Daily, Weekly or monthly depending on the schedule of the commission or bonus earned.

● Does this tax include payments for income tax to local government agencies?

No, Local Government Agencies do not collect income tax. There are various other levies they may collect including- Radio and TV License, Parking Permits, Signage, etc.

● Will this apply to all commissions and bonuses earned?

Yes

● Can my WHT be deducted monthly instead of weekly?

No, it depends solely on the schedule of the commission plan or bonus earned. WHT Payments are made on every commission payment transaction (Daily, weekly, monthly & Quarterly)

● Where can I see the summary of my total WHT being remitted?

Agents can view this under the transaction section and can export the list to Excel and filter WHT deductions.

● Is this WHT applicable to other betting companies that run agencies?

Betking as a corporate responsible company is obliged to abide by the WHT Law. However, we will continue to remit the VAT 7.5% on commission/bonus and other levies (including Agent Tax, Signage Fee, Business Premises, Integrated Tax, etc.) on your behalf.

● Is WHT applicable for the 10% jackpot payment on Kingmakers and Duke Jackpot?

No

● How will I know how much WHT Tax is deducted?

The Withholding Tax to be deducted from your commission and bonuses will be 5% of all Commissions and Bonuses paid to you. This amount deducted will also be reflected in the agent reports.

● Will I get a Tax Identification Number (TIN) because of the WHT deduction?

You need to visit the State Internal Revenue Service/ Tax Office nearest to you to obtain your Tax Identification Number (TIN).